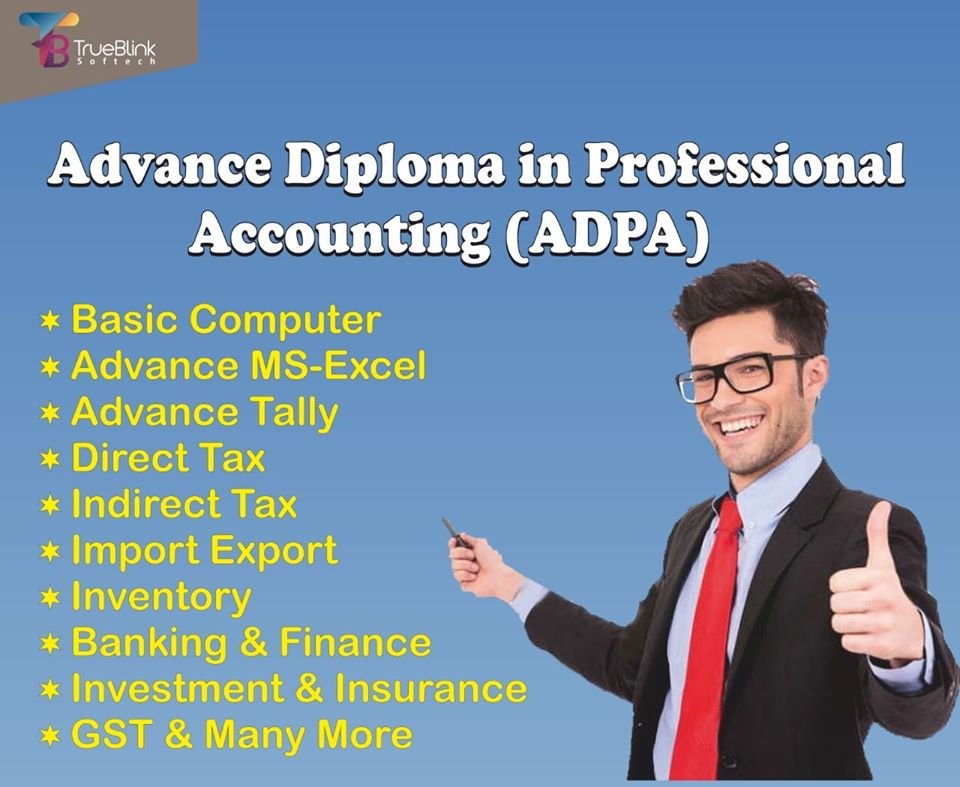

Accounting Courses

Duration : 4 Months

Module - 1 - Manual accounting Classification of Accounting Trading and P&L Account Golden Rules of Accounting Finalization of Accounting Cash Flow & Fund Flow Module - 2 - Computer Fundamental Opertaing System, Dektop Setting, Windows. MS office - Word / Excel / Power Point Advance Excel Internet Technology Module - 3 - Tally ERP With GST Intro to Tally ERP Company Information Accounting Master & Inventory Voucher Entry, Budget & Bills Purchase order, sales order Point of Sale Taxation Advance Accounting Advance Inventory Bank reconciliation Payroll System Module - 4 - Taxation Introduction of GST Taxable Event & Supply Procedure of GST ITC,Registration,Invoice Accounts of GST Return &Format of GST Registration Income Tax - Income Heads Deducations(ATC to ATU) TDS/ TCS/ Advance Tax Assessments & ITR PAN Card Application Banking & Finance Syllabus Commercial Banking Structure of Commercial Banking in India Banking Products and Operation Deposits Type of Accounts Loan and Advances Technology in Banking New Banking Facilities and Services Electronic Clearing Subsidiaries of Bank Credit Monitoring and Recovery Financial Supervision Physical Follow up Legal aspects in Banking TDS and Interest Rates RBI and Its Function and How it regulates the Bank KYC Documents Financial Accounting Investment Banking Financial Planning Profit and Loss Account Financial Ratios SEBI and Regulations Valuation Ratio Qualities of Success Investing Computer Fundamental MS Excel & advance Excel Internet Technology Finance Financial System Non-Banking Institution Mutual Funds Insurance & Housing Finance Companies Financial Instruments Primary & Secondary Securities Financial Services Information Financial System Financial Market

Module - 1 - Manual accounting Classification of Accounting Trading and P&L Account Golden Rules of Accounting Finalization of Accounting Cash Flow & Fund Flow Module - 2 - Computer Fundamental Opertaing System, Dektop Setting, Windows. MS office - Word / Excel / Power Point Advance Excel Internet Technology Module - 3 - Tally ERP With GST Intro to Tally ERP Company Information Accounting Master & Inventory Voucher Entry, Budget & Bills Purchase order, sales order Point of Sale Taxation Advance Accounting Advance Inventory Bank reconciliation Payroll System Module - 4 - Taxation Introduction of GST Taxable Event & Supply Procedure of GST ITC,Registration,Invoice Accounts of GST Return &Format of GST Registration Income Tax - Income Heads Deducations(ATC to ATU) TDS/ TCS/ Advance Tax Assessments & ITR PAN Card Application Banking & Finance Syllabus Commercial Banking Structure of Commercial Banking in India Banking Products and Operation Deposits Type of Accounts Loan and Advances Technology in Banking New Banking Facilities and Services Electronic Clearing Subsidiaries of Bank Credit Monitoring and Recovery Financial Supervision Physical Follow up Legal aspects in Banking TDS and Interest Rates RBI and Its Function and How it regulates the Bank KYC Documents Financial Accounting Investment Banking Financial Planning Profit and Loss Account Financial Ratios SEBI and Regulations Valuation Ratio Qualities of Success Investing Computer Fundamental MS Excel & advance Excel Internet Technology Finance Financial System Non-Banking Institution Mutual Funds Insurance & Housing Finance Companies Financial Instruments Primary & Secondary Securities Financial Services Information Financial System Financial Market